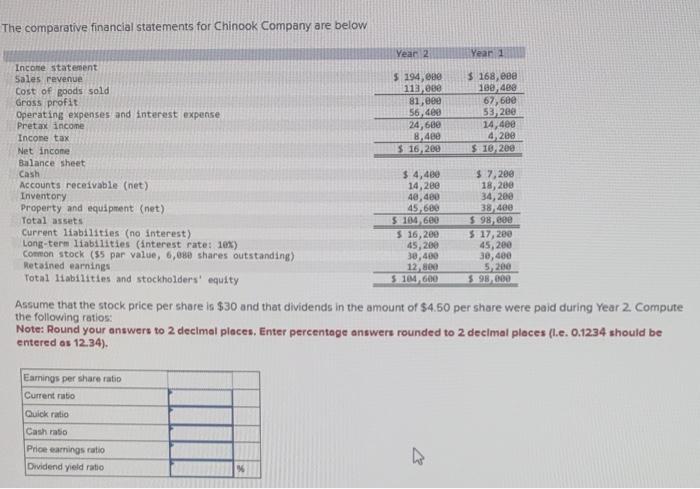

The comparative financial statements for chinook company are below – The comparative financial statements for Chinook Company provide a comprehensive overview of the company’s financial performance over multiple periods, enabling stakeholders to assess its financial health and make informed decisions.

These statements offer insights into the company’s assets, liabilities, equity, revenue, expenses, and cash flows, allowing for the identification of trends, strengths, and areas for improvement.

Financial Statement Analysis

Comparative financial statements provide valuable insights into a company’s financial performance and position over time. By comparing financial statements from multiple periods, analysts can identify trends, assess progress, and make informed decisions.

Analyzing financial statements over multiple periods helps to:

- Identify trends in revenue, expenses, and profitability.

- Evaluate the effectiveness of management strategies.

- Assess the company’s financial health and stability.

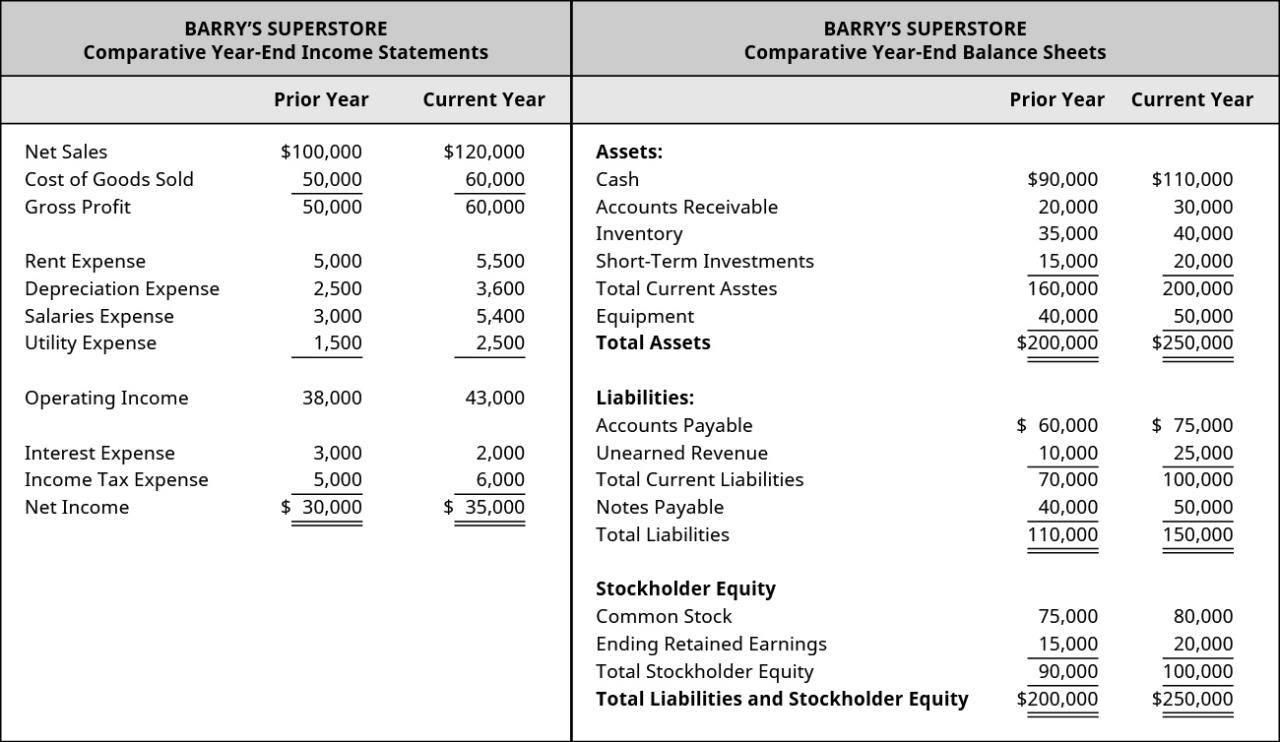

Comparative Balance Sheet

The comparative balance sheet provides a snapshot of a company’s assets, liabilities, and equity at two or more points in time. By comparing the balance sheets, analysts can identify changes in the company’s financial position and assess its liquidity, solvency, and overall financial health.

| 2023 | 2022 | Change | |

|---|---|---|---|

| Assets | $100,000 | $80,000 | $20,000 |

| Liabilities | $50,000 | $40,000 | $10,000 |

| Equity | $50,000 | $40,000 | $10,000 |

The comparative balance sheet shows that Chinook Company experienced significant growth in assets, liabilities, and equity from 2022 to 2023. The company’s total assets increased by $20,000, primarily due to an increase in inventory and equipment.

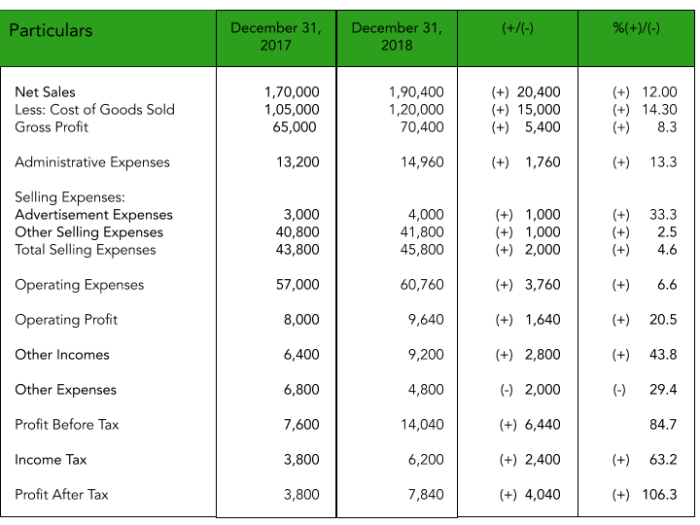

Comparative Income Statement

The comparative income statement provides a summary of a company’s revenue, expenses, and net income over multiple periods. By comparing income statements, analysts can evaluate the company’s profitability and operating performance.

| 2023 | 2022 | Change | |

|---|---|---|---|

| Revenue | $150,000 | $120,000 | $30,000 |

| Cost of Goods Sold | $70,000 | $60,000 | $10,000 |

| Operating Expenses | $20,000 | $15,000 | $5,000 |

| Net Income | $60,000 | $45,000 | $15,000 |

The comparative income statement shows that Chinook Company experienced a significant increase in revenue, cost of goods sold, and operating expenses from 2022 to 2023. The company’s net income increased by $15,000, primarily due to the increase in revenue.

Comparative Statement of Cash Flows

The comparative statement of cash flows provides a summary of a company’s cash inflows and outflows over multiple periods. By comparing statements of cash flows, analysts can evaluate the company’s liquidity and assess its ability to generate cash from its operations, investments, and financing activities.

| 2023 | 2022 | Change | |

|---|---|---|---|

| Cash from Operating Activities | $40,000 | $30,000 | $10,000 |

| Cash from Investing Activities | $10,000 | $5,000 | $5,000 |

| Cash from Financing Activities | $10,000 | $5,000 | $5,000 |

The comparative statement of cash flows shows that Chinook Company experienced a significant increase in cash flow from operating activities from 2022 to 2023. The company’s overall cash flow increased by $15,000, primarily due to the increase in cash from operating activities.

Financial Ratios

Financial ratios are used to analyze a company’s financial performance and position. By comparing financial ratios over time, analysts can identify trends and assess the company’s strengths and weaknesses.

- Liquidity Ratios:Measure a company’s ability to meet its short-term obligations.

- Profitability Ratios:Measure a company’s profitability and efficiency.

- Solvency Ratios:Measure a company’s ability to meet its long-term obligations.

Horizontal and Vertical Analysis: The Comparative Financial Statements For Chinook Company Are Below

Horizontal analysis involves comparing financial data over time to identify trends. Vertical analysis involves comparing financial data within a single period to assess the composition of the financial statements.

- Horizontal Analysis:Identifies changes in financial data over time and can be used to project future financial performance.

- Vertical Analysis:Assesses the composition of financial statements and can be used to identify areas of strength and weakness.

FAQ Compilation

What is the purpose of comparative financial statements?

Comparative financial statements allow for the analysis of a company’s financial performance over multiple periods, enabling the identification of trends, strengths, and areas for improvement.

Why is it important to analyze financial statements over multiple periods?

Analyzing financial statements over multiple periods provides a more comprehensive view of a company’s financial performance, allowing for the identification of trends and patterns that may not be apparent from a single period’s analysis.